Welcome to Watts & Wealth, your go-to source for insights on dividend stocks, utility stocks, and income-generating investments. In this Week 43 update, we analyze the latest shifts in the utility sector and highlight key opportunities for income-focused investors. Let’s dive into the data, explore the top performers, and adjust strategies for a resilient portfolio.

Macroeconomic Overview: Stability and Resilience in Utility Stocks

The current macroeconomic landscape features mixed indicators, but utility stocks continue to shine for income investors due to their low volatility and steady dividend yields. With interest rates stabilizing, dividend stocks in the utility sector remain a defensive play. As oil prices fluctuate, renewables gain momentum, positioning utility stocks that focus on clean energy as attractive long-term investments. Traditional utilities face challenges from regulatory pressures and growing consumer demand for sustainable energy sources.

In Week 43, utility stocks demonstrated resilience, maintaining stability amid broader market disruptions. As we approach the end of 2024, expect renewable-focused income stocks to stay in the spotlight, while fossil-fuel-dependent utilities adapt to regulatory changes.

Stock Highlights: Top Dividend and Utility Stocks of the Week

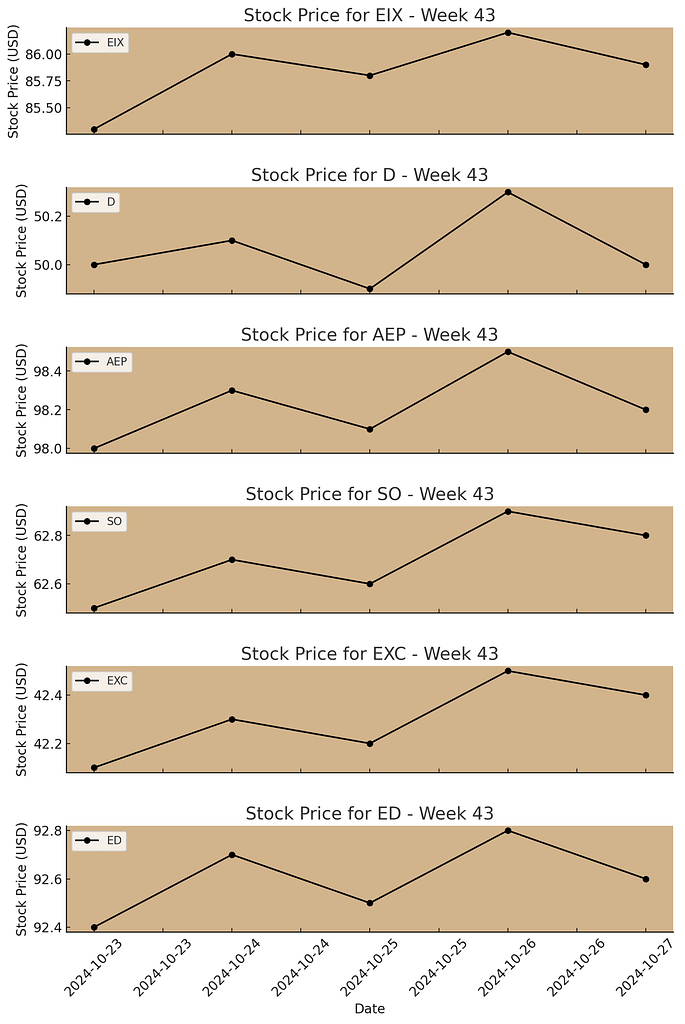

• Edison International (EIX): Increased by 1.2%, driven by optimism around renewable energy projects. However, wildfire liabilities remain a potential risk.

• Dominion Energy (D): Dropped 0.9% due to regulatory concerns and restructuring. Despite this, its high 5.6% dividend yield appeals to income-focused investors.

• American Electric Power (AEP): Gained 1.5% following strong earnings and grid modernization efforts, making it a solid choice for dividend seekers.

• Southern Company (SO): Rose 1.3%, bolstered by solar energy expansions, attracting growth-oriented and income-focused investors alike.

• Exelon (EXC): Gained 0.2%, showing steady performance as investors anticipate future growth catalysts.

RSI Analysis: Value Opportunities Among Income Stocks

For Week 43, we analyzed utility stocks across the RSI spectrum, identifying key opportunities for value investors interested in dividend and income stocks.

1. Dominion Energy (D) – RSI of 27: Deep in oversold territory, presenting a potential bargain for dividend investors. Regulatory challenges remain, but a reversal could yield gains.

• MACD: Downward trend, with signs of a possible recovery.

2. Edison International (EIX) – RSI of 50: Moderately undervalued, ideal for long-term income investors focused on renewable energy.

• MACD: Stabilizing, indicating potential for gradual gains.

3. Consolidated Edison (ED) – RSI of 46: Neutral, well-suited for conservative, income-focused investors seeking stability.

• MACD: Shows upward momentum, signaling steady gains.

4. American Electric Power (AEP) – RSI of 45: Neutral with growth potential; its strong earnings make it a reliable hold.

• MACD: Momentum is steady, a solid hold for dividend stability.

5. Southern Company (SO) – RSI of 71: Approaching overbought status, signaling a possible pullback. Long-term solar investments remain a strong appeal.

• MACD: Holding strong, but a correction may be on the horizon.

6. Exelon (EXC) – RSI of 54: Neutral, appealing for low-volatility income investors.

• MACD: Minimal fluctuation, supporting its role as a steady income stock.

Dividend Stability: Consistent Returns from Top Utility Stocks

Utility stocks continued to deliver reliable dividends in Week 43, reinforcing their appeal for income-focused investors:

• Edison International (EIX): Dividend yield steady at 4.2%.

• Dominion Energy (D): Offers a high yield at 5.6%, drawing income-oriented investors.

• American Electric Power (AEP): Yield stable at 4.0%, reflecting its reliability.

• Southern Company (SO): Attractive yield of 4.5%, suitable for long-term income growth.

• Exelon (EXC): Reliable 3.6% yield, ensuring steady income for dividend investors.

Looking Ahead: Opportunities and Caution in Utility and Dividend Stocks

As we close out 2024, utility stocks are expected to remain a solid defensive investment for income stability. Key areas to watch include ongoing renewable energy projects, grid modernization efforts, and potential regulatory shifts affecting fossil-fuel-based utilities like Dominion Energy.

Final Thoughts on Dividend Stocks and Income Stability

Week 43 highlights the enduring appeal of utility stocks for income stability. As dividend and utility stocks continue to offer defensive growth, now is an excellent time to review your holdings. Stay connected with Watts & Wealth for consistent insights into dividend and income-generating stocks to build a resilient portfolio.

Keep your portfolio powered up, and let’s grow your financial future with reliable income stocks.